Within the evolution of Mathworks’ MATLAB programming environment, finally, in the most recent version labelled 2013a we received a longly awaited line-command facilitation for pulling stock data directly from the Yahoo! servers. What does that mean for quants and algo traders? Honestly, a lot. Now, simply writing a few commands we can have nearly all what we want. However, please keep in mind that Yahoo! data are free therefore not always in one hundred percent their precision remains at the level of the same quality as, e.g. downloaded from Bloomberg resources. Anyway, just for pure backtesting of your models, this step introduces a big leap in dealing with daily stock data. As usual, we have a possibility of getting open, high, low, close, adjusted close prices of stocks supplemented with traded volume and the dates plus values of dividends.

In this post I present a short example how one can retrieve the data of SPY (tracking the performance of S&P500 index) using Yahoo! data in a new Matlab 2013a and I show a simple code how one can test the time period of buying-holding-and-selling SPY (or any other stock paying dividends) to make a profit every time.

The beauty of Yahoo! new feature in Matlab 2013a has been fully described in the official article of Request data from Yahoo! data servers where you can find all details required to build the code into your Matlab programs.

Model for Dividends

It is a well known opinion (based on many years of market observations) that one may expect the drop of stock price within a short timeframe (e.g. a few days) after the day when the stock’s dividends have been announced. And probably every quant, sooner or later, is tempted to verify that hypothesis. It’s your homework. However, today, let’s look at a bit differently defined problem based on the omni-working reversed rule: what goes down, must go up. Let’s consider an exchange traded fund of SPDR S&P 500 ETF Trust labelled in NYSE as SPY.

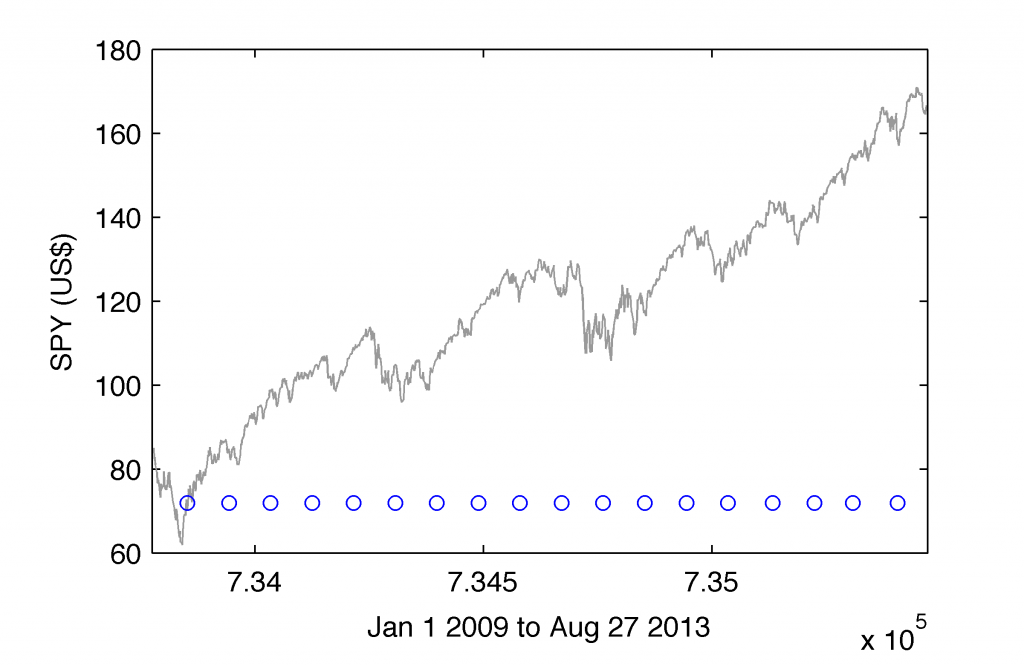

First, let’s pull out the Yahoo! data of adjusted Close prices of SPY from Jan 1, 2009 up to Aug 27, 2013

% Yahoo! Stock Data in Matlab and a Model for Dividend Backtesting

% (c) 2013 QuantAtRisk.com, by Pawel Lachowicz

close all; clear all; clc;

date_from=datenum('Jan 1 2009');

date_to=datenum('Aug 27 2013');

stock='SPY';

adjClose = fetch(yahoo,stock,'adj close',date_from,date_to);

div = fetch(yahoo,stock,date_from,date_to,'v')

returns=(adjClose(2:end,2)./adjClose(1:end-1,2)-1);

% plot adjusted Close price of and mark days when dividends

% have been announced

plot(adjClose(:,1),adjClose(:,2),'color',[0.6 0.6 0.6])

hold on;

plot(div(:,1),min(adjClose(:,2))+10,'ob');

ylabel('SPY (US$)');

xlabel('Jan 1 2009 to Aug 27 2013');

and visualize them:

Having the data ready for backtesting, let’s look for the most profitable period of time of buying-holding-and-selling SPY assuming that we buy SPY one day after the dividends have been announced (at the market price), and we hold for $dt$ days (here, tested to be between 1 and 40 trading days).

% find the most profitable period of holding SPY (long position)

neg=[];

for dt=1:40

buy=[]; sell=[];

for i=1:size(div,1)

% find the dates when the dividends have been announced

[r,c,v]=find(adjClose(:,1)==div(i,1));

% mark the corresponding SPY price with blue circle marker

hold on; plot(adjClose(r,1),adjClose(r,2),'ob');

% assume you buy long SPY next day at the market price (close price)

buy=[buy; adjClose(r-1,1) adjClose(r-1,2)];

% assume you sell SPY in 'dt' days after you bought SPY at the market

% price (close price)

sell=[sell; adjClose(r-1-dt,1) adjClose(r-1-dt,2)];

end

% calculate profit-and-loss of each trade (excluding transaction costs)

PnL=sell(:,2)./buy(:,2)-1;

% summarize the results

neg=[neg; dt sum(PnL<0) sum(PnL<0)/length(PnL)];

end

If we now sort the results according to the percentage of negative returns (column 3 of neg matrix), we will be able to get:

>> sortrows(neg,3)

ans =

18.0000 2.0000 0.1111

17.0000 3.0000 0.1667

19.0000 3.0000 0.1667

24.0000 3.0000 0.1667

9.0000 4.0000 0.2222

14.0000 4.0000 0.2222

20.0000 4.0000 0.2222

21.0000 4.0000 0.2222

23.0000 4.0000 0.2222

25.0000 4.0000 0.2222

28.0000 4.0000 0.2222

29.0000 4.0000 0.2222

13.0000 5.0000 0.2778

15.0000 5.0000 0.2778

16.0000 5.0000 0.2778

22.0000 5.0000 0.2778

27.0000 5.0000 0.2778

30.0000 5.0000 0.2778

31.0000 5.0000 0.2778

33.0000 5.0000 0.2778

34.0000 5.0000 0.2778

35.0000 5.0000 0.2778

36.0000 5.0000 0.2778

6.0000 6.0000 0.3333

8.0000 6.0000 0.3333

10.0000 6.0000 0.3333

11.0000 6.0000 0.3333

12.0000 6.0000 0.3333

26.0000 6.0000 0.3333

32.0000 6.0000 0.3333

37.0000 6.0000 0.3333

38.0000 6.0000 0.3333

39.0000 6.0000 0.3333

40.0000 6.0000 0.3333

5.0000 7.0000 0.3889

7.0000 7.0000 0.3889

1.0000 9.0000 0.5000

2.0000 9.0000 0.5000

3.0000 9.0000 0.5000

4.0000 9.0000 0.5000

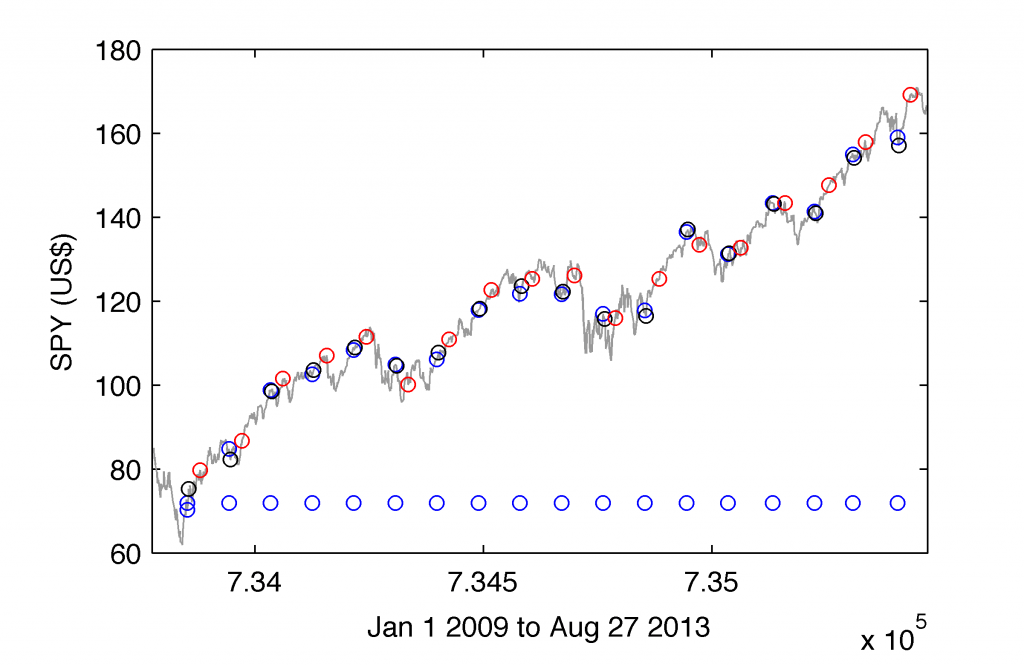

what simply indicates at the most optimal period of holding the long position in SPY equal 18 days. We can mark all trades (18 day holding period) in the chart:

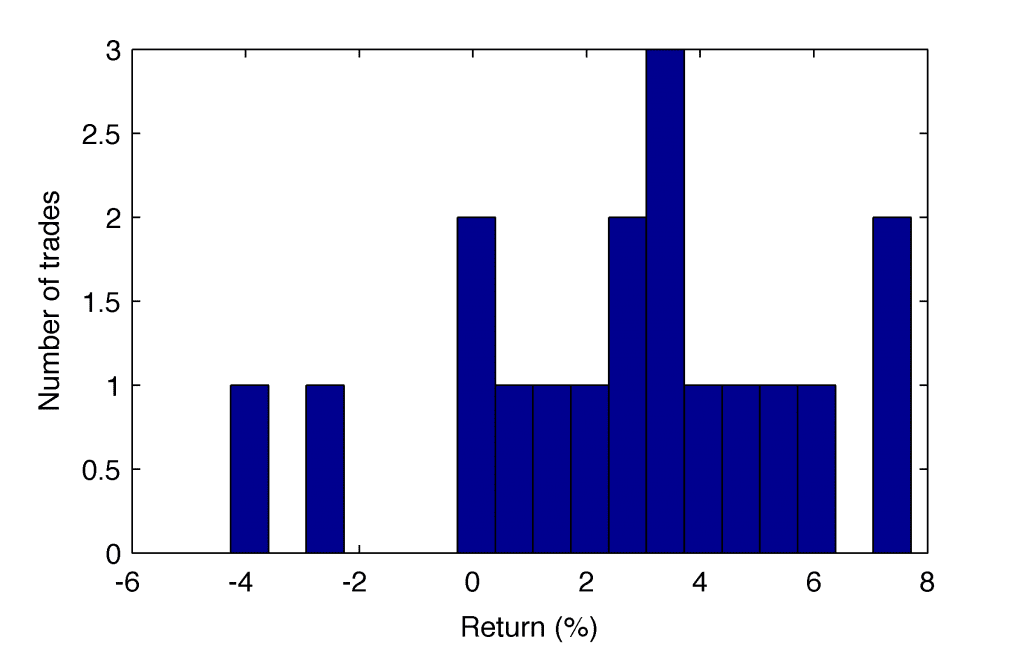

where the trade open and close prices (according to our model described above) have been marked in the plot by black and red circle markers, respectively. Only 2 out of 18 trades (PnL matrix) occurred to be negative with the loss of 2.63% and 4.26%. The complete distribution of profit and losses from all trades can be obtained in the following way:

figure(2);

hist(PnL*100,length(PnL))

ylabel('Number of trades')

xlabel('Return (%)')

returning

Let’s make some money!

The above Matlab code delivers a simple application of the newest build-in connectivity with Yahoo! server and the ability to download the stock data of our interest. We have tested the optimal holding period for SPY since the beginning of 2009 till now (global uptrend). The same code can be easily used and/or modified for verification of any period and any stock for which the dividends had been released in the past. Fairly simple approach, though not too frequent in trading, provides us with some extra idea how we can beat the market assuming that the future is going to be/remain more or less the same as the past. So, let’s make some money!

1 comment

Question, why do your returns appear to be the opposite of what they really are? i.e. positive returns are displaying as negative and negative returns are displaying as positive. Not sure if I am reading your code and results incorrectly as I am a newbie in matlab!