When you come in contact with cryptocurrencies, e.g. Bitcoin (BTC), you quickly realise that there is no single price of BTC at any given moment. The reason is that Bitcoin is traded on different markets. It can be worth more on Coinbase exchange and less on Kraken exchange. In particular, the Coindesk Bitcoin Price Index (XBP) aims to unify the BTC price into a single number based on four markets that meet specific criteria (see here for details on XBP calculation). In practice, the use of a cryptocurrency index seems to be valuable for press and newspapers, not for traders and investors. They usually look at the exchange where their positions are opened and track the exchange-related prices.

The idea of trading the same cryptocurrency on different crypto-markets at the same time is not new. It dates back to trading of a pair of stocks (equities) which prices are highly correlated and cointegrated and is known as statistical arbitrage (Stat Arb). The basic statistical arbitrage is a trading strategy that assumes that the price-series of two assets put into a pair (stocks or, in our case, cryptocurrencies) are non-stationary and mean reverting over time. In other words, when one coin in a pair outperforms the other, the poorer performing coin is bought long with the expectation that it will climb towards its outperforming partner, the other is sold short.

In this post we will see how to combine theory with real market data, identify statistical arbitrage opportunities to buy/sell, create a simple backtest in Python to prove that Stat Arb is not dead and, in fact, that you can make money in cryptocurrency markets! Ready for launch? Let’s go!

1. Markets where a given Cryptocurrency is Traded

Building an algo-trading model employing Stat Arb starts with building your knowledge on data available. Naturally, first thing you would like to know are the names of crypto-markets where the coin of your choice is traded. In all what follows, let’s assume we will be interested in trading Ether (ETH) or, more precisely, the ETH/USD ratio.

Again, we make use of CryptoComapre.com’s API which blended with Python can act promptly to deliver required information:

# Earning Money in Cryptocurrency Markets by Spotting

# Statistical Arbitrage Opportunities

#

# tested in Python 3.5.4

# (c) 2017, Dr. Pawel Lachowicz

import numpy as np

import pandas as pd

from scipy import stats

from matplotlib import pyplot as plt

from datetime import datetime

import json

from bs4 import BeautifulSoup

import requests

%matplotlib inline

grey = .6, .6, .6

# define a pair

fsym = "ETH"

tsym = "USD"

url = "https://www.cryptocompare.com/api/data/coinsnapshot/?fsym=" + \

fsym + "&tsym=" + tsym

response = requests.get(url)

soup = BeautifulSoup(response.content, "html.parser")

dic = json.loads(soup.prettify())

print(dic)

Above, we fetch the coin snapshot (ETH/USD) that returns a JSON-formatted data structure which we grab in a Python’s dictionary, dic. At the first glance, the variable of dic contains a wealth of information:

{'Data': {'AggregatedData': {'FLAGS': '4',

'FROMSYMBOL': 'ETH',

'HIGH24HOUR': '301.14',

'HIGHDAY': '300.65',

'LASTMARKET': 'Exmo',

'LASTTRADEID': '24442414',

'LASTUPDATE': '1509915676',

'LASTVOLUME': '0.00212',

'LASTVOLUMETO': '0.61979896',

'LOW24HOUR': '294.59',

'LOWDAY': '295.2',

'MARKET': 'CCCAGG',

'OPEN24HOUR': '297.85',

'OPENDAY': '300.04',

'PRICE': '296.8',

'TOSYMBOL': 'USD',

'TYPE': '5',

'VOLUME24HOUR': '206617.29367793005',

'VOLUME24HOURTO': '61511364.75962282',

'VOLUMEDAY': '181568.2062645673',

'VOLUMEDAYTO': '53913839.277825184'},

'Algorithm': 'Ethash',

'BlockNumber': 4497207,

'BlockReward': 3.0,

'Exchanges': [{'FLAGS': '1',

'FROMSYMBOL': 'ETH',

'HIGH24HOUR': '305.45',

'LASTTRADEID': '1060368',

'LASTUPDATE': '1509915610',

'LASTVOLUME': '0.027127',

'LASTVOLUMETO': '8.23982625',

'LOW24HOUR': '301.04300027',

'MARKET': 'Cexio',

'OPEN24HOUR': '301.66699999',

'PRICE': '303.75',

'TOSYMBOL': 'USD',

'TYPE': '2',

'VOLUME24HOUR': '2053.973031999999',

'VOLUME24HOURTO': '622022.5332660044'},

{'FLAGS': '1',

'FROMSYMBOL': 'ETH',

'HIGH24HOUR': '302',

'LASTTRADEID': '14074021',

'LASTUPDATE': '1509915662',

'LASTVOLUME': '0.00003349',

'LASTVOLUMETO': '0.0099672938',

'LOW24HOUR': '296',

'MARKET': 'Coinbase',

'OPEN24HOUR': '298.75',

'PRICE': '297.62',

'TOSYMBOL': 'USD',

'TYPE': '2',

'VOLUME24HOUR': '48653.64503668011',

'VOLUME24HOURTO': '14517318.477630273'},

...

where, for the purpose of this task, we solely aim to extract the names of all exchanges where ETH/USD is alive:

market = []

d = dic['Data']['Exchanges'] # a list

for i in range(len(d)):

market.append(d[i]['MARKET'])

print(market[-1])

Cexio Coinbase Coinroom Gemini Bitfinex Cryptsy Tidex CCEX Gatecoin BTCE Kraken OKCoin Exmo WavesDEX BitTrex Remitano Poloniex HitBTC Lykke BitBay LiveCoin Yobit Quoine

2. Cryptocurrency Markets according to the Volume traded within last 24 hours

Which market should we choose for setting up our Stat Arb trading strategy? It can be done by filtering the market data according to highest volume traded within last twenty four hours. Why? Simply because the more the better. With higher interest in a specific market we cut on liquidity risk and vouchsafe faster execution times (the spread becomes secondary problem for you to worry about).

In Python we use a special method (line #43) to filter the list and get a desired result:

vol = []

d = dic['Data']['Exchanges'] # a list

for i in range(len(d)):

vol.append([d[i]['MARKET'], round(float(d[i]['VOLUME24HOUR']),2)])

# sort a list of sublists according to 2nd item in a sublist

vol = sorted(vol, key=lambda x: -x[1])

# Cryptocurrency Markets according to Volume traded within last 24 hours

for e in vol:

print("%10s%15.2f" % (e[0], e[1]))

Bitfinex 99874.91

Coinbase 48653.65

HitBTC 20080.36

Poloniex 11928.00

Gemini 7676.25

Kraken 7354.39

BitTrex 5720.76

Cexio 2053.97

Exmo 1621.00

Quoine 963.88

OKCoin 424.38

Lykke 162.65

Yobit 124.61

Tidex 117.18

LiveCoin 61.12

CCEX 37.04

Remitano 1.70

Gatecoin 1.19

Coinroom 0.78

Cryptsy 0.00

BTCE 0.00

WavesDEX 0.00

BitBay 0.00

Let’s select the Top 10 Markets trading ETH/USD for further consideration:

# Select Top 10 Cryptocurrency Markets markets = [e[0] for e in vol][0:10] print(markets)

['Bitfinex', 'Coinbase', 'HitBTC', 'Poloniex', 'Gemini', 'Kraken', 'BitTrex', 'Cexio', 'Exmo', 'Quoine']

Just keep in mind that the order of that list may change if your rerun the script on a different day, different than Nov 7, 2017.

3. Downloading Cryptocurrency Price Time-Series by specifying Exchange

In my previous article on Cryptocurrency Time-Series for N-CryptoAsset Portfolio Analysis in Python I described you the code that enables fetching the OHLC time-series for any cryptocurrency using CryptoComapre.com’s API. Luckily enough, there is a chance to update that code (see line #68) in the way that from now on it would allow us to specify the market for which we wish to download the coin’s price-series:

def fetchCryptoOHLC_byExchange(fsym, tsym, exchange):

# a function fetches a crypto OHLC price-series for fsym/tsym and stores

# it in a pandas DataFrame; uses specific Exchange as provided

# src: https://www.cryptocompare.com/api/

cols = ['date', 'timestamp', 'open', 'high', 'low', 'close']

lst = ['time', 'open', 'high', 'low', 'close']

timestamp_today = datetime.today().timestamp()

curr_timestamp = timestamp_today

for j in range(2):

df = pd.DataFrame(columns=cols)

url = "https://min-api.cryptocompare.com/data/histoday?fsym=" + fsym + \

"&tsym=" + tsym + "&toTs=" + str(int(curr_timestamp)) + \

"&limit=2000" + "&e=" + exchange

response = requests.get(url)

soup = BeautifulSoup(response.content, "html.parser")

dic = json.loads(soup.prettify())

for i in range(1, 2001):

tmp = []

for e in enumerate(lst):

x = e[0]

y = dic['Data'][i][e[1]]

if(x == 0):

# timestamp-to-date

td = datetime.fromtimestamp(int(y)).strftime('%Y-%m-%d')

tmp.append(td) #(str(timestamp2date(y)))

tmp.append(y)

if(np.sum(tmp[-4::]) > 0):

df.loc[len(df)] = np.array(tmp)

df.index = pd.to_datetime(df.date)

df.drop('date', axis=1, inplace=True)

curr_timestamp = int(df.iloc[0][0])

if(j == 0):

df0 = df.copy()

else:

data = pd.concat([df, df0], axis=0)

return data.astype(np.float64)

Having that, let’s write a code that allows us to not only download the ETH/USD time-series but also place them into pandas’ DataFrame (we will make the data to start from June 2 and end on Nov 5, 2017):

# if a variable 'cp' exists, delete it

if ('cp' in globals()) or ('cp' in locals()): del cp

# download daily OHLC price-series for ETH/USD for a given 'market'

# extract close-price (cp)

print("%s/%s" % (fsym, tsym))

for market in markets:

print("%12s... " % market, end="")

df = fetchCryptoOHLC_byExchange(fsym, tsym, market)

ts = df[(df.index > "2017-06-01") & (df.index <= "2017-11-05")]["close"]

ts.name = market

if ('cp' in globals()) or ('cp' in locals()):

cp = pd.concat([cp, ts], axis=1, ignore_index=False)

else:

cp = pd.DataFrame(ts)

print("downloaded")

ETH/USD

Bitfinex... downloaded

Coinbase... downloaded

HitBTC... downloaded

Poloniex... downloaded

Gemini... downloaded

Kraken... downloaded

BitTrex... downloaded

Cexio... downloaded

Exmo... downloaded

Quoine... downloaded

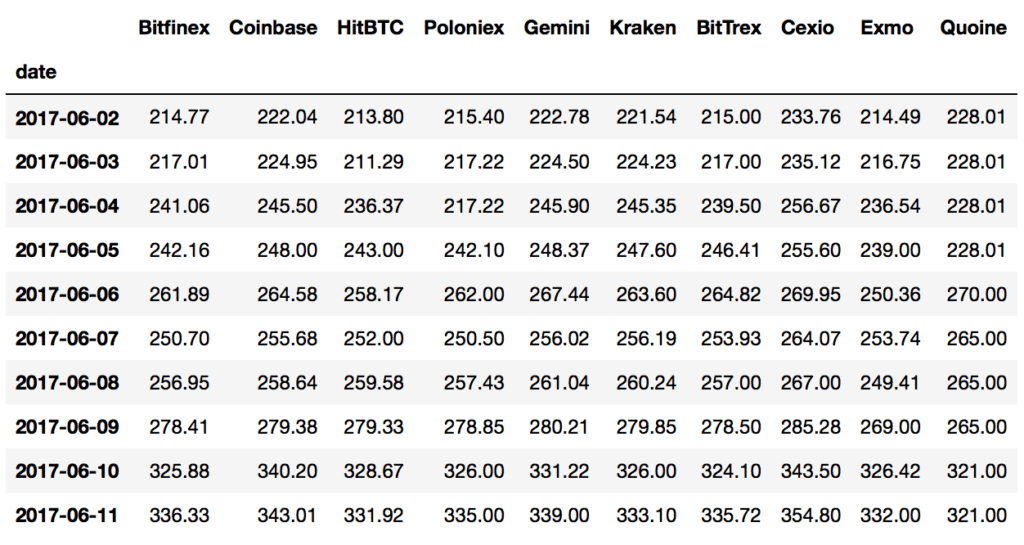

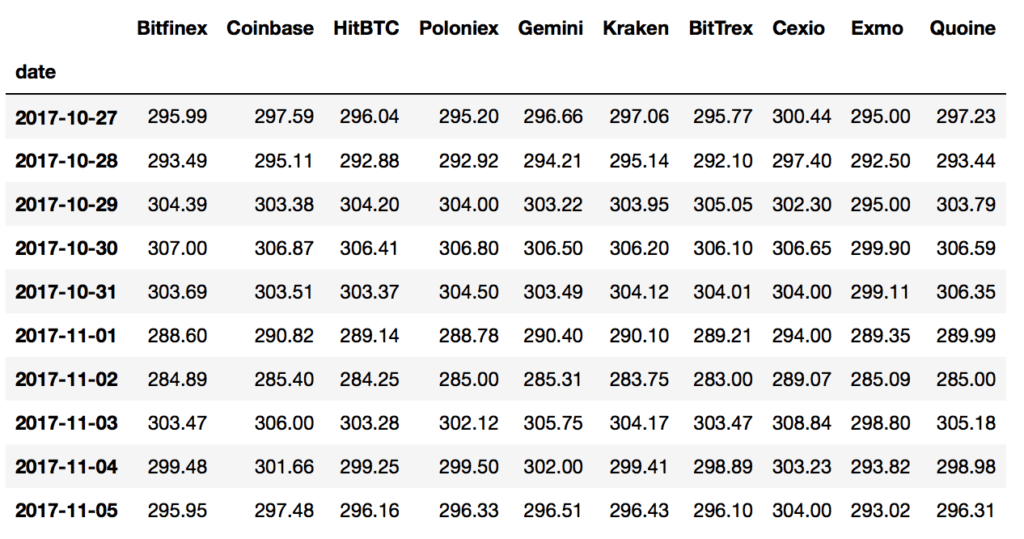

what we can verify by displaying the first and the last ten lines of DataFrame:

print(cp.head(10)) print(cp.tail(10))

Therefore, we have daily close price time-series coming from 10 different markets in our hands. The numbers confirm the noticeable differences among these markets at the close. Now, let’s see how one can pick up a (some) good market(s) for our Stat Arb trading strategy.

4. Average Spread Estimation for ETH/USD among different Markets

By spread, here, I do not mean the distance between Bid and Ask for ETH/USD. Rather than that, given all time-serires, I mean the measurement of the average distance (in USD) between price-series (daily) for the time period covered (Jun 2 till Nov 5, 2018) and supplementing it with one standard deviation, i.e.

dist = []

for i in range(cp.shape[1]):

for j in range(i):

if(i != j):

x = np.array(cp.iloc[:,i], dtype=np.float32)

y = np.array(cp.iloc[:,j], dtype=np.float32)

diff = np.abs(x-y)

avg = np.mean(diff)

std = np.std(diff, ddof=1)

dist.append([cp.columns[i], cp.columns[j], avg, std])

dist = sorted(dist, key=lambda x: -x[2])

print("%10s%10s%10s%10s\n" % ("Coin1", "Coin2", "Mean", "Std Dev"))

for e in dist:

print("%10s%10s%10.5f%10.2f" % (e[0], e[1], e[2], e[3]))

In our case, the code returns the following results:

Coin1 Coin2 Mean Std Dev

Quoine Exmo 31.18089 38.58

Quoine Cexio 31.07745 37.74

Quoine Poloniex 30.22300 40.33

Quoine Bitfinex 30.10771 40.25

Quoine BitTrex 30.05567 40.36

Quoine Coinbase 29.90038 40.07

Quoine Kraken 29.82280 40.04

Quoine HitBTC 29.82038 39.48

Quoine Gemini 29.71771 40.15

Cexio HitBTC 9.88497 8.28

Cexio Poloniex 9.68694 8.26

Exmo Cexio 9.58420 5.15

Cexio BitTrex 9.57796 8.27

Cexio Bitfinex 9.56936 7.96

Cexio Gemini 8.57503 8.20

Cexio Kraken 8.25248 6.54

Cexio Coinbase 7.84471 6.23

Exmo BitTrex 6.37057 5.34

Exmo Poloniex 6.23357 5.20

Exmo HitBTC 6.22764 5.00

Exmo Bitfinex 6.12720 5.01

Exmo Gemini 6.04459 6.21

Exmo Kraken 6.00204 4.35 *

Exmo Coinbase 5.74370 4.20

HitBTC Coinbase 2.77898 4.38

Gemini HitBTC 2.77732 5.61

Kraken HitBTC 2.63350 3.89

BitTrex Gemini 2.51720 4.78

BitTrex Kraken 2.48357 3.18

BitTrex Coinbase 2.46280 3.25

Gemini Poloniex 2.34541 5.04

Kraken Poloniex 2.30720 3.41

Poloniex Coinbase 2.27586 3.47

Kraken Bitfinex 2.16834 2.73

Gemini Bitfinex 2.16121 4.60

Coinbase Bitfinex 2.10006 2.81

Kraken Gemini 1.91146 5.16

BitTrex HitBTC 1.88293 3.52

Poloniex HitBTC 1.55051 3.61

Kraken Coinbase 1.51592 2.52

HitBTC Bitfinex 1.48223 3.33

BitTrex Poloniex 1.43484 2.39

BitTrex Bitfinex 1.23981 1.92

Gemini Coinbase 1.23809 4.75

Poloniex Bitfinex 0.68331 1.92

In theory, we want to select two markets with the highest mean spread at the lowest standard deviation (assuming that the distances calculated follow the normal distribution). In practice, given above numbers, you can check all combinations (in the backtest we are going to write below) in order to find out what what really works best.

5. Statistical Arbitrage Trading Strategy for ETH/USD

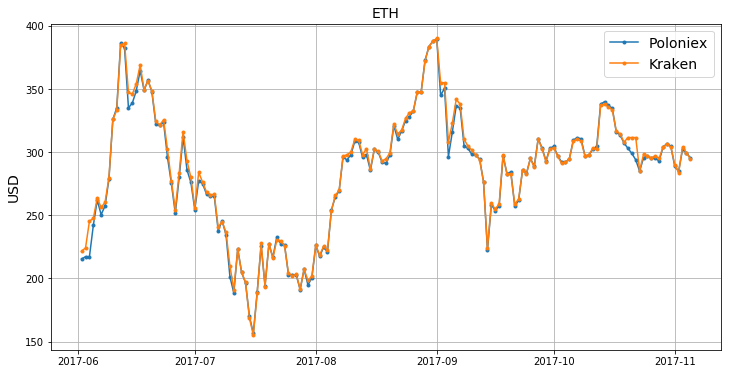

Let me choose Exmo and Kraken exchanges. The mean spread of 6 USD at $1\sigma$ of 4.25 USD gives a lot of hope for good fishing! We start from downloading the corresponding time-series (df1 and df2) followed by their quick visualisation:

market1 = "Exmo" market2 = "Kraken" df1 = fetchCryptoOHLC_byExchange(fsym, tsym, market1) df2 = fetchCryptoOHLC_byExchange(fsym, tsym, market2) # trim df1 = df1[(df1.index > "2017-06-01") & (df1.index <= "2017-11-05")] df2 = df2[(df2.index > "2017-06-01") & (df2.index <= "2017-11-05")] # checkpoint print(df1.close.shape[0], df2.close.shape[0]) # both sizes must be equal # plotting plt.figure(figsize=(20,10)) plt.plot(df1.close, '.-', label=market1) plt.plot(df2.close, '.-', label=market2) plt.legend(loc=2) plt.title(fsym, fontsize=12) plt.ylabel(tsym, fontsize=12) plt.grid()

Every trading strategy requires some boundary conditions. Let’s summarise them all together before coding:

Therefore, we start trading with USD 5,000 on Exmo and Kraken account, respectively. That will allow us to monitor the “cash” level of both accounts after each trade. The full code to perform the backtest would look like this:

# Backtesting Stat Arb trading strategy for ETH/USD at Exmo and Kraken

# cryptocurrency exchanges

# initial parameters

investment = 10000 # USD

account1, account2 = investment/2, investment/2 # USD

position = 0.5*(investment/2) # USD

roi = []

ac1 = [account1]

ac2 = [account2]

money = []

pnl_exch1 = []

pnl_exch2 = []

trade = False

n = df1.close.shape[0] # number of data points

# running the backtest

for i in range(n):

p1 = float(df1.close.iloc[i])

p2 = float(df2.close.iloc[i])

if(p1 > p2):

asset1 = "SHORT"

asset2 = "LONG"

if(trade == False):

open_p1 = p1 # open prices

open_p2 = p2

open_asset1 = asset1

open_asset2 = asset2

trade = True

print("new traded opened")

new_trade = False

elif(asset1 == open_asset1):

new_trade = False # flag

elif(asset1 == open_asset2):

new_trade = True # flag

elif(p2 > p1):

asset1 = "LONG"

asset2 = "SHORT"

if(trade == False):

open_p1 = p1 # open prices

open_p2 = p2

open_asset1 = asset1

open_asset2 = asset2

trade = True

print("new traded opened")

new_trade = False

elif(asset1 == open_asset1):

new_trade = False # flag

elif(asset1 == open_asset2):

new_trade = True # flag

if(i == 0):

print(df1.close.iloc[i], df2.close.iloc[i], \

asset1, asset2, trade, "----first trade info")

else:

if(new_trade):

# close current position

if(open_asset1 == "SHORT"):

# PnL of both trades

pnl_asset1 = open_p1/p1 - 1

pnl_asset2 = p2/open_p2 -1

pnl_exch1.append(pnl_asset1)

pnl_exch2.append(pnl_asset2)

print(open_p1, p1, open_p2, p2, open_asset1, \

open_asset2, pnl_asset1, pnl_asset2)

# update both accounts

account1 = account1 + position*pnl_asset1

account2 = account2 + position*pnl_asset2

print("accounts [USD] = ", account1, account2)

if((account1 <=0) or (account2 <=0)):

print("--trading halted")

break

# return on investment (ROI)

total = account1 + account2

roi.append(total/investment-1)

ac1.append(account1)

ac2.append(account2)

money.append(total)

print("ROI = ", roi[-1])

print("trade closed\n")

trade = False

# open a new trade

if(asset1 == "SHORT"):

open_p1 = p1

open_p2 = p2

open_asset1 = asset1

open_asset2 = asset2

else:

open_p1 = p1

open_p2 = p2

open_asset1 = asset1

open_asset2 = asset2

trade = True

print("new trade opened", asset1, asset2, \

open_p1, open_p2)

# close current position

if(open_asset1 == "LONG"):

# PnL of both trades

pnl_asset1 = p1/open_p1 -1

pnl_asset2 = open_p2/p2 - 1

pnl_exch1.append(pnl_asset1)

pnl_exch2.append(pnl_asset2)

print(open_p1, p1, open_p2, p2, open_asset1, \

open_asset2, pnl_asset1, pnl_asset2)

# update both accounts

account1 = account1 + position*pnl_asset1

account2 = account2 + position*pnl_asset2

print("accounts [USD] = ", account1, account2)

if((account1 <=0) or (account2 <=0)):

print("--trading halted")

break

# return on investment (ROI)

total = account1 + account2

roi.append(total/investment-1)

ac1.append(account1)

ac2.append(account2)

money.append(total)

trade_pnl.append(pnl_asset1+pnl_asset2)

print("ROI = ", roi[-1])

print("trade closed\n")

trade = False

# open a new trade

if(open_asset1 == "SHORT"):

open_p1 = p1

open_p2 = p2

open_asset1 = asset1

open_asset2 = asset2

else:

open_p1 = p1

open_p2 = p2

open_asset1 = asset1

open_asset2 = asset2

new_trade = False

trade = True

print("new trade opened:", asset1, asset2, \

open_p1, open_p2)

else:

print(" ",df1.close.iloc[i], df2.close.iloc[i], \

asset1, asset2)

An exemplary trading log you should recover based on data sample selected above commences with:

new traded opened

214.49 221.54 LONG SHORT True ----first trade info

216.75 224.23 LONG SHORT

236.54 245.35 LONG SHORT

239.0 247.6 LONG SHORT

250.36 263.6 LONG SHORT

253.74 256.19 LONG SHORT

249.41 260.24 LONG SHORT

269.0 279.85 LONG SHORT

214.49 326.42 221.54 326.0 LONG SHORT 0.5218425101403328 -0.32042944785276073

accounts [USD] = 6304.606275350832 4198.926380368098

ROI = 0.05035326557189301

trade closed

new trade opened: SHORT LONG 326.42 326.0

326.42 332.0 326.0 333.1 SHORT LONG -0.016807228915662553 0.021779141104294464

accounts [USD] = 6262.588203061676 4253.374233128834

ROI = 0.05159624361905091

trade closed

new trade opened LONG SHORT 332.0 333.1

332.0 332.0 333.1 333.1 LONG SHORT 0.0 0.0

accounts [USD] = 6262.588203061676 4253.374233128834

ROI = 0.05159624361905091

trade closed

new trade opened: LONG SHORT 332.0 333.1

332.0 390.0 333.1 385.0 LONG SHORT 0.17469879518072284 -0.1348051948051947

accounts [USD] = 6699.3351910134825 3916.3612461158473

ROI = 0.06156964371293294

trade closed

new trade opened: SHORT LONG 390.0 385.0

393.2 386.13 SHORT LONG

369.41 347.24 SHORT LONG

357.3 345.99 SHORT LONG

365.81 354.17 SHORT LONG

370.61 368.95 SHORT LONG

357.0 349.5 SHORT LONG

359.82 356.48 SHORT LONG

358.03 348.5 SHORT LONG

334.0 324.48 SHORT LONG

325.95 321.6 SHORT LONG

334.0 325.5 SHORT LONG

317.47 302.15 SHORT LONG

295.0 277.0 SHORT LONG

264.0 254.49 SHORT LONG

390.0 280.93 385.0 283.66 SHORT LONG 0.38824618232299857 -0.26322077922077913

accounts [USD] = 7669.950646820979 3258.3092980638994

ROI = 0.09282599448848772

trade closed

...

In the first trade we open a long position at Exmo at price of 214.49 and a short position at Kraken at 221.54. After 8 days, there has been a new trading signal generated what caused to close both positions. The close price at Exmo was 326.42 so we made a profit +52.18% while the concurrent short position at Kraken closed with a loss of 32.04% because of ETH/USD rose from 221.54 up to 326.0. In result, the cash at Exmo account went up from 5,000 to 6,304.61 while at Kraken account down from 5,000 to 4,198.93 (=5000 – 0.3204$\times$2500). A new trade has been opened with a short position at Exmo and long position at Kraken, etc.

Having the backtest code, there are many places you can take it and analyse its variants. If you build-in the commission fee structure, you may find the difference in profits with and without the fees. I strongly encourage to experiment with it. Who knows… maybe you will become a millionaire too?! :-)

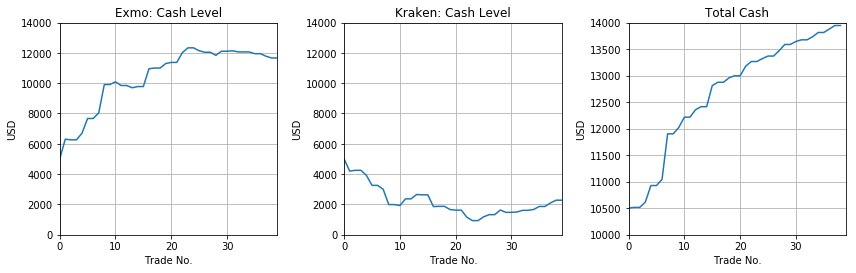

Just to assist with the understanding of some numbers we captured along the backtest (see all Python lists; lines #163-168), first let’s have a look at the cash level in both accounts:

plt.figure(figsize=(12,7))

plt.subplot(2,3,1)

plt.plot(ac1)

plt.title("Exmo: Cash Level")

plt.xlabel("Trade No."); plt.ylabel("USD")

plt.grid()

plt.xlim([0, len(money)])

plt.ylim([0, 14001])

plt.subplot(2,3,2)

plt.plot(ac2)

plt.title("Kraken: Cash Level")

plt.xlabel("Trade No."); plt.ylabel("USD")

plt.grid()

plt.xlim([0, len(money)])

plt.ylim([0, 14001])

plt.subplot(2,3,3)

plt.plot(np.array(money))

plt.title("Total Cash")

plt.xlabel("Trade No."); plt.ylabel("USD")

plt.grid()

plt.xlim([0, len(money)])

plt.ylim([investment, 14000])

plt.tight_layout()

plt.savefig('cashlevels.png', bbox_inches='tight')

These charts indicate that within our Stat Arb strategy the performance of trades at Exmo was much much better than at Kraken. Only the final ca. 10 trades at Kraken brought some profits. Both characteristics have their conclusion as presented on the third chart: Total Cash.

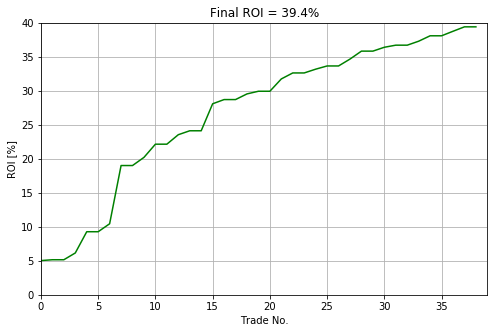

In other words, after 5 months of running the strategy, we ended up with a nice +39.4% return on our initial investment of USD 10,000, i.e.

plt.figure(figsize=(8,5))

plt.plot(np.array(roi)*100, 'g')

plt.xlabel("Trade No.");

plt.ylabel("Equity Growth [%]")

plt.title("ROI = %f.2%%" % (100*roi[-1]))

plt.xlim([0, len(money)])

plt.ylim([0, 40])

plt.grid()

plt.savefig('roi.png', bbox_inches='tight')

Final Note

Greed is good. Use this algo wisely! Don’t buy a jet. Instead, make your wife happy. Tiffany would do the job… :-)

7 comments

Hey very cool blog!! Man .. Beautiful .. Wonderful .. I will bookmark your website and

take the feeds additionally? I’m satisfied to search out numerous useful info right here within the post, we need work out more

techniques on this regard, thanks for sharing. . . . . .

Hi nice article. trade_pnl is not declared in your code !

the only thing you are missing, is the delirious cost to trade cryptos on those new pseudo exchanges…ROI < 0

Hi Pawel,

Very nice article! One tip can be using the request session to leverage the keep-alive connection.

s = requests.session()

trying something like:

response = s.get(url)

instead of

response = request.get(url)

Best,

Ronaldo

when running

====================

# Select Top 10 Cryptocurrency Markets by their volume

markets = [e[0] for e in vol][0:10]

print(markets)

==================

i am getting this (which is not as shown above):

Bitfinex 220700.34

[‘Bitfinex’, ‘Coinbase’, ‘Gemini’, ‘Poloniex’, ‘HitBTC’, ‘Kraken’, ‘BitTrex’, ‘Cexio’, ‘Exmo’, ‘Quoine’]

Coinbase 144549.34

[‘Bitfinex’, ‘Coinbase’, ‘Gemini’, ‘Poloniex’, ‘HitBTC’, ‘Kraken’, ‘BitTrex’, ‘Cexio’, ‘Exmo’, ‘Quoine’]

Gemini 44508.90

[‘Bitfinex’, ‘Coinbase’, ‘Gemini’, ‘Poloniex’, ‘HitBTC’, ‘Kraken’, ‘BitTrex’, ‘Cexio’, ‘Exmo’, ‘Quoine’]

Poloniex 37787.74

[‘Bitfinex’, ‘Coinbase’, ‘Gemini’, ‘Poloniex’, ‘HitBTC’, ‘Kraken’, ‘BitTrex’, ‘Cexio’, ‘Exmo’, ‘Quoine’]

I will be happy if you could assist me what did i do wrong. thanks!

Are your “prices” mid-point quotes, or trades? If trades, are you sure you are not simply fitting to stale trade noise? I’d wager this entire strategy is untradeable.

Hello Pawel,

Very good article :)

I think you are missing declare trade_pnl = [] array in your code !

Regards

Ludo.